south dakota vehicle sales tax exemption

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. When Sales Tax Is Exempt in South Dakota South Dakota offers exemption from car sales tax in multiple different situations including.

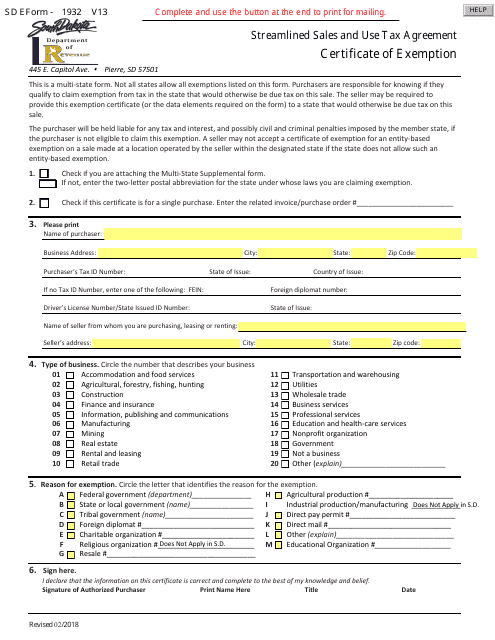

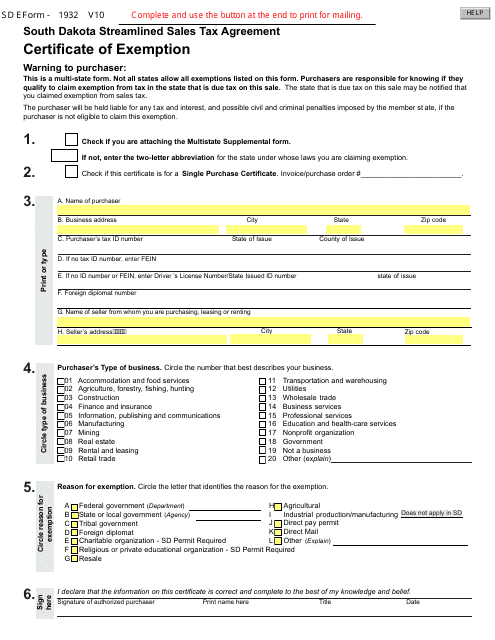

Form 1932 Download Fillable Pdf Or Fill Online Certificate Of Exemption Streamlined Sales And Use Tax Agreement South Dakota Templateroller

South Dakota Streamlined Sales and Use Tax Agreement Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items.

. But this applies only to vehicles that you will not operate on streets highways or waterways of South Dakota. 2200 prior to July 1 2016 17-Out-of-state vehicle titled option of licensing in the. The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45.

South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. 14-Any motor vehicle sold or transferred which is eleven or more model years old and which is sold or transferred for 2500 or less and any boat which is eleven or more model years old and which is sold or transferred for 2500 or less. Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32-5-27.

2021 south dakota state sales tax. Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must. South Dakota is subject to sales or use tax.

This means that you save the sales taxes you would otherwise have paid on the 5000 value of your trade-in. South Dakota Vehicle Sales Tax Exemption. Vehicleboat and house trailer owned by United States State County Municipality Township.

Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. Search for a job. Any titling transfer fees.

South dakota has a 45 statewide sales tax rate but also has 193 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1136 on top of the state. This page discusses various sales tax exemptions in South Dakota. The range of total sales tax rates within the state of South Dakota is between 4 and 65.

One exception is that the sale or purchase of a motor vehicle subject to the motor vehicle excise tax is not subject to sales or use tax. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission. A title transfer fee of 1000 will apply.

13 rows In South Dakota certain items may be exempt from the sales tax to all consumers not just. 45 sales use tax standing rock special jurisdiction. You must file a separate application in order to receive state.

Local jurisdictions impose additional sales taxes up to 2. Dealers are required to collect the state sales tax and any. South Dakota is subject to sales or use tax.

First retail sale of vehicle is taxable. State sales tax of 4225 percent plus your local sales tax Document on the purchase price less trade-in allowance if any. Use tax is also collected on the consumption use or storage of goods.

Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a south dakota titled vehicle according to exemption 36. The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption.

Any motor vehicle sold or transferred that is eleven or more model years old and which is sold or transferred for 2500 or. One exception is the sale or purchase of a motor vehicle which is subject to the motor vehicle excise tax. If your organization makes taxable sales or purchases obtaining.

Different areas have varying additional sales taxes as well. In South Dakota the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. SDCL 10-45 A use tax of the same rate as the sales tax applies to all goods products and services that are used stored or consumed in South Dakota on which South Dakota sales tax was not paid.

Registration license plate fees based on either taxable horsepower or vehicle weight. South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. The purchaser or consumer of the goods or services is respon-.

Also the vehicle must be hauled or transported to its destination. There are four reasons that products and services would be exempt from South Dakota sales tax. There are limited situations where you can obtain a title without paying motor vehicle sales tax as a buyer.

Governmental or sales tax exempt agency. Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32-5-27. The state of South Dakota levies a 4 state sales tax on the retail sale lease or rental of most goods and some services.

13 rows In South Dakota certain items may be exempt from the sales tax to all consumers not just. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

The average sales tax rate on vehicles across the state is. 600 title processing fee. The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption.

With few exceptions the sale of products and services in South Dakota are subject to sales tax or use tax. All car sales in South Dakota are subject to the 4 statewide sales tax. There are hereby specifically exempted from the provisions of this chapter and from the computation of the amount of tax imposed by it the gross receipts from sales of tangible personal property and the sale furnishing or service of electrical energy natural and artificial gas and communication service to the United States to the State of South Dakota or to any other.

For vehicles that are being rented or leased see see taxation of leases and rentals.

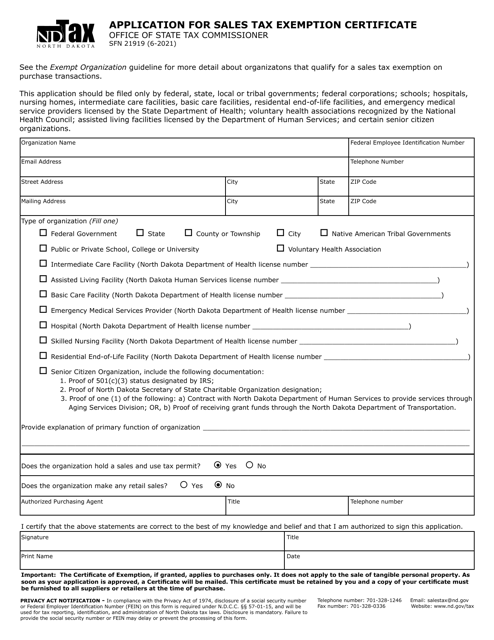

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

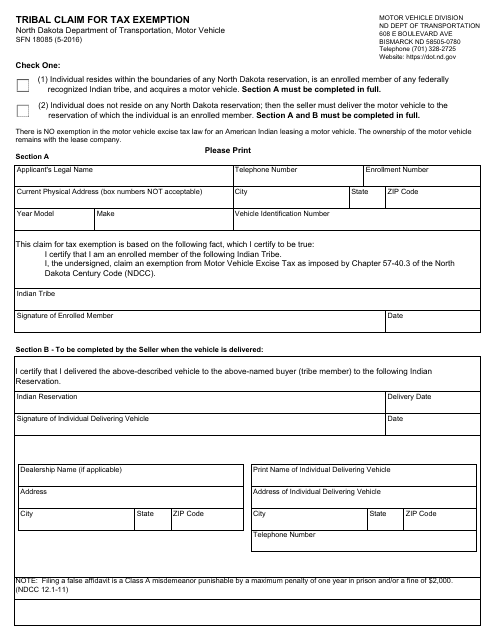

Form Sfn18085 Download Fillable Pdf Or Fill Online Tribal Claim For Tax Exemption North Dakota Templateroller

Sales Tax On Cars And Vehicles In South Dakota

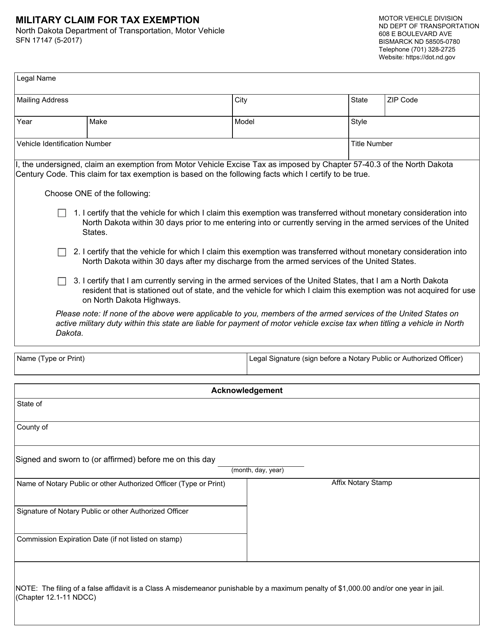

Form Sfn17147 Download Fillable Pdf Or Fill Online Military Claim For Tax Exemption North Dakota Templateroller

South Dakota Sales Tax Small Business Guide Truic

Printable South Carolina Sales Tax Exemption Certificates

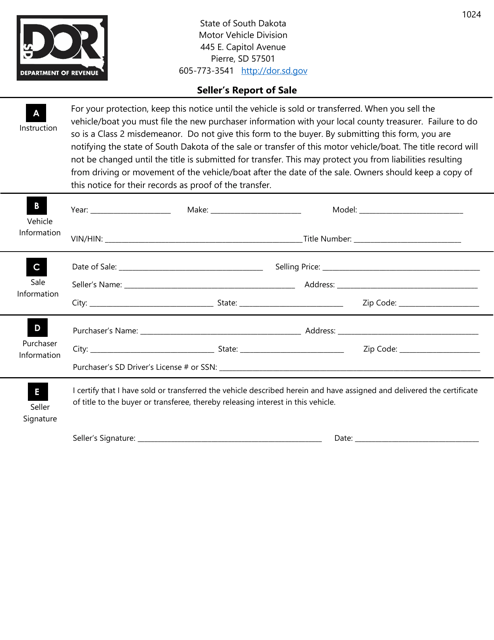

Form 1024 Download Printable Pdf Or Fill Online Seller S Report Of Sale South Dakota Templateroller

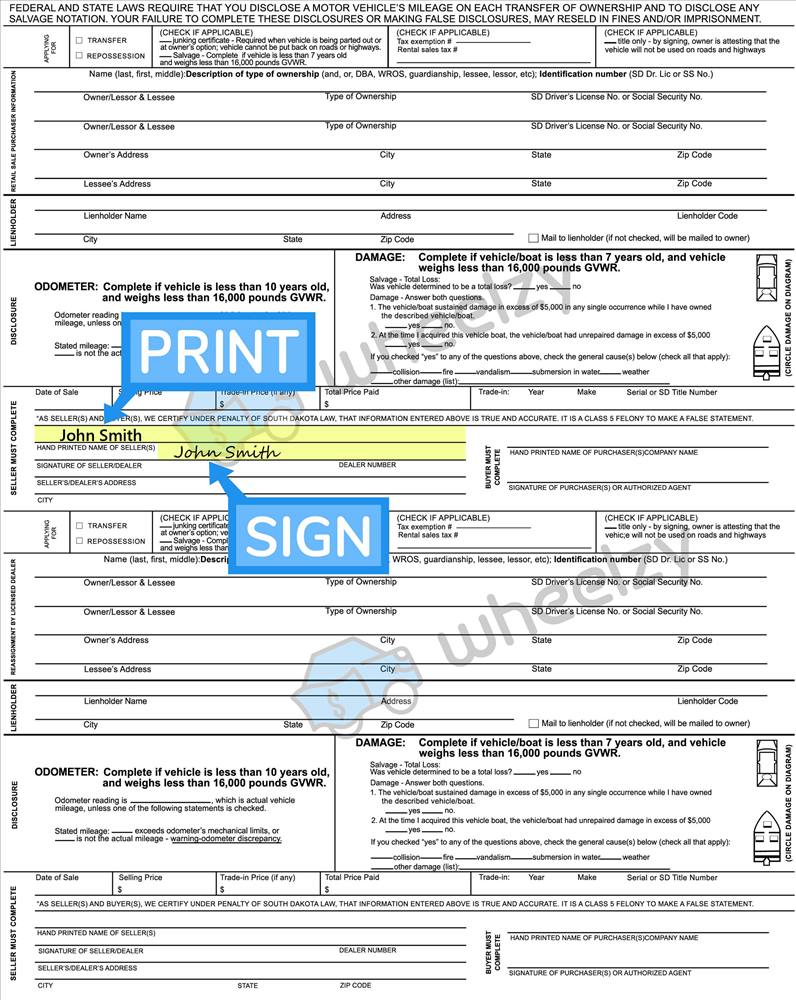

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

Form 1932 Download Fillable Pdf Or Fill Online Certificate Of Exemption South Dakota Templateroller

4 Reasons A Transaction May Be Exempt From South Dakota Sales Tax South Dakota Department Of Revenue